Como usar Stock RSI?

How do you set RSI in stocks

The actual RSI value is calculated by indexing the indicator to 100, through the use of the following RSI formula example: RSI = 100 – (100 /1 + RS)

How do you use RSI trading strategy

One RSI trading strategy used in trending markets would be to wait for the indicator to signal an overbought condition during an uptrend. The trader then waits for RSI to drop below 50, which signals a long entry. If the trend remains in place price will typically recover off this level and move to new highs.

How should I set up my RSI indicator

Best settings for the RSI

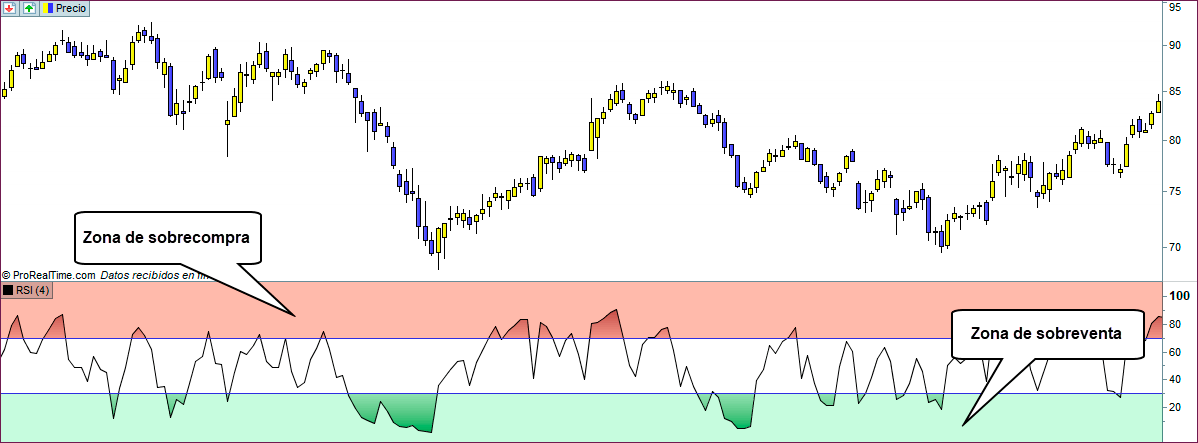

The most used period in the RSI indicator is 14. However, you can always tweak this setting by lengthening or narrowing down the period. You can also tweak the levels you want the overbought and oversold levels. The default levels are 70 and 30 but you can tweak them to suit your style.

Is RSI a good trading indicator

The relative strength indicator is not as reliable in trending markets as it is in trading ranges. In fact, most traders understand that the signals given by the RSI in strong upward or downward trends often can be false.

Which RSI indicator is best

What Is a Good RSI Indicator Traders who are looking for investment opportunities should look for RSI values that hit 30 or fall below that level. This allows them to look for investment options that may be undervalued where the price may increase in the future.

What is the best range for RSI

Although the default setting is 14, the intraday traders usually prefer a range of 8-11 periods. Now this range is reduced to increase the sensitivity and also to monitor the market closely so that you can efficiently trade within minutes. If you are setting a range of 70-30, then 50 is a potential buy signal.

How do you use RSI to buy and sell

Investors using RSI generally stick to a couple of simple rules. First, low RSI levels, typically below 30 (red line), indicate oversold conditions—generating a potential buy signal. Conversely, high RSI levels, typically above 70 (green line), indicate overbought conditions—generating a potential sell signal.

What is a good RSI indicator

What Is a Good RSI Indicator Traders who are looking for investment opportunities should look for RSI values that hit 30 or fall below that level. This allows them to look for investment options that may be undervalued where the price may increase in the future.

What is the best RSI to look at

What Is a Good RSI Indicator Traders who are looking for investment opportunities should look for RSI values that hit 30 or fall below that level. This allows them to look for investment options that may be undervalued where the price may increase in the future.

What is the 5 star RSI strategy

The 5-Star Relative Strength Index (RSI) Strategy-Short

If a bearish candle is formed at the 60 RSI level, the prices may bounce back from there, and one can enter the stock for shorting. The stoploss can be placed at the high of that bearish candlestick, and the target can be the 40 Relative Strength Index levels.

What is a good RSI number to buy

The relative strength index (RSI) provides short-term buy and sell signals. Low RSI levels (below 30) generate buy signals. High RSI levels (above 70) generate sell signals.

Is RSI 20 80 or 30 70

The most common settings that traders tend to watch are: 80/20 where 80 is an overbought level and 20 is an oversold level. 70/30 where 70 is overbought and 30 is oversold.

What if RSI is between 30 and 70

The RSI oscillates between zero and 100. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Signals can be generated by looking for divergences and failure swings. RSI can also be used to identify the general trend.

What is the best RSI to sell

Low RSI levels, below 30, generate buy signals and indicate an oversold or undervalued condition. High RSI levels, above 70, generate sell signals and suggest that a security is overbought or overvalued. A reading of 50 denotes a neutral level or balance between bullish and bearish positions.

Is RSI below 30 buy or sell

The RSI is a technical indicator that measures the strength of a stock's price movement. A value below 30 is typically read as an indication that the stock is oversold. Disclaimer:Investment in securities market are subject to market risks, read all the related documents carefully before investing.

What is the best RSI ratio

In an uptrend or bull market, the RSI tends to remain in the 40 to 90 range with the 40-50 zone acting as support. During a downtrend or bear market the RSI tends to stay between the 10 to 60 range with the 50-60 zone acting as resistance.

What does a good RSI look like

What Is a Good RSI Indicator Traders who are looking for investment opportunities should look for RSI values that hit 30 or fall below that level. This allows them to look for investment options that may be undervalued where the price may increase in the future.

What RSI number to use

In an uptrend or bull market, the RSI tends to remain in the 40 to 90 range with the 40-50 zone acting as support. During a downtrend or bear market the RSI tends to stay between the 10 to 60 range with the 50-60 zone acting as resistance.

What is the best RSI to buy at

The relative strength index (RSI) provides short-term buy and sell signals. Low RSI levels (below 30) generate buy signals. High RSI levels (above 70) generate sell signals. The S&P 500's RSI suggests the recent rally has room to continue.

What is RSI 60 40 or 70 30

Low RSI levels, below 30, generate buy signals and indicate an oversold or undervalued condition. High RSI levels, above 70, generate sell signals and suggest that a security is overbought or overvalued. A reading of 50 denotes a neutral level or balance between bullish and bearish positions.

What does RSI 40 60 mean

In an uptrend or bull market, the RSI tends to remain in the 40 to 90 range with the 40-50 zone acting as support. During a downtrend or bear market the RSI tends to stay between the 10 to 60 range with the 50-60 zone acting as resistance.

Is RSI above 70 buy or sell

The relative strength index (RSI) provides short-term buy and sell signals. Low RSI levels (below 30) generate buy signals. High RSI levels (above 70) generate sell signals.

Is RSI 30 buy or sell

The relative strength index (RSI) provides short-term buy and sell signals. Low RSI levels (below 30) generate buy signals. High RSI levels (above 70) generate sell signals.

What if RSI is below 20

This implies that stock may rebound. Some traders, in an attempt to avoid false signals from the RSI, use more extreme RSI values as buy or sell signals, such as RSI readings above 80 to indicate overbought conditions and RSI readings below 20 to indicate oversold conditions.

What is the best RSI value to use

The common levels to pay attention to when trading with the RSI are 70 and 30. An RSI of over 70 is considered overbought. When it below 30 it is considered oversold. Trading based on RSI indicators is often the starting point when considering a trade, and many traders place alerts at the 70 and 30 marks.

0 Comments