What is the main disadvantage of leasing?

What are the disadvantages of leasing

Disadvantages of leasing or renting equipment

you can't claim capital allowances on the leased assets if the lease period is for less than five years (and in some cases less than seven years) you may have to put down a deposit or make some payments in advance.

What is the disadvantage of leasing in business

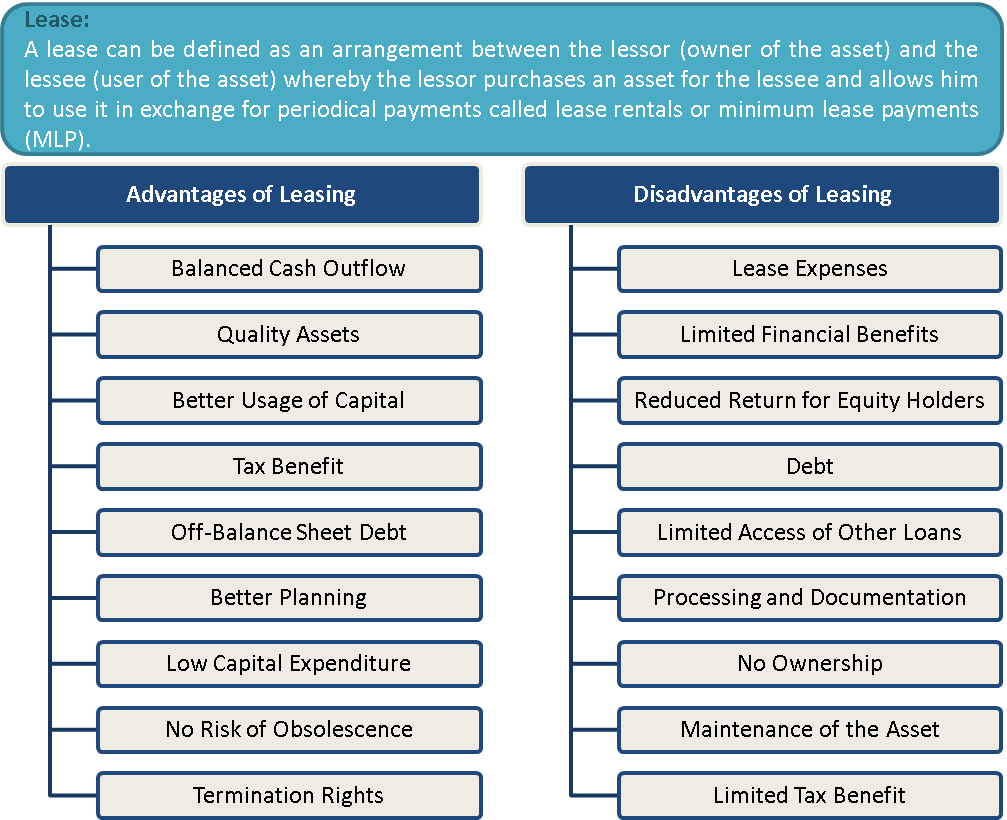

Limited Financial Benefits

If paying lease payments toward land, the business cannot benefit from any appreciation in the value of the land. The long-term lease agreement also remains a burden on the business as the agreement is locked and the expenses for several years are fixed.

What is the problem of leasing

The lease becomes economically viable only when the transfer's effective tax rate is low. In addition, taxes like sales tax, wealth tax, additional tax, surcharge etc. add to the cost of leasing. Thus leasing becomes more expensive form of financing than conventional mode of finance such as hire purchase.

What is leasing and its advantages and disadvantages

Leasing is the easiest method of financing fixed assets. No mortgage or hypothecation is required. Restrictions involved in long-term borrowing from financial institutions are avoided. Formalities involved in leasing are much less than in case of borrowing from financial institutions.

What are 5 disadvantages of leasing

Cons of Leasing a CarYou Don't Own the Car. The obvious downside to leasing a car is that you don't own the car at the end of the lease.It Might Not Save You Money.Leasing Can Be More Complicated than Buying.Leased Cars Are Restricted to a Limited Number of Miles.Increased Insurance Premiums.

What is the major advantage of leasing

Conserves Cash: Leasing provides 100% financing. Capital can be conserved and used to finance other projects or activities. Access to Capital: Leasing does not impact existing credit lines – e.g. an existing bank operating line, thereby providing another source of capital.

What is the disadvantage of lessor

The lessor bears the risk of the asset becoming obsolete. The lessor can't charge increased lease rentals in a situation where the market value of the asset increases. It takes a substantial time to recover the initial cost of the asset.

What are the main advantages of leasing

There are numerous advantages to lease financingLess initial cash investment required.Lower monthly payments.Tax benefits.Fast turnaround time.Conserve your capital.Avoid technological obsolescence.Assist corporate growth.Let the equipment pay for itself.

What are the factors affecting leasing

Factors Favoring Leasing:

Credit rating: The company has not established a credit rating sufficient to support a mortgage. Maintenance: The landlord is responsible for maintaining the property. Property: You have been unable to find a suitable property that is for sale.

What is the one advantage of a lease

Lower monthly payments

One of the greatest advantages of leasing a car is typically lower monthly payments than if you were obtaining financing to purchase the car. When you finance a vehicle purchase, you pay the entire purchase price of a vehicle over the life of the financing plus interest.

What is leasing advantage

Lower monthly payments

One of the greatest advantages of leasing a car is typically lower monthly payments than if you were obtaining financing to purchase the car. When you finance a vehicle purchase, you pay the entire purchase price of a vehicle over the life of the financing plus interest.

Which is not an advantage of leasing vs purchasing

Leasing also has disadvantages, including: Potentially higher overall costs, depending on the length of the lease's term. Continued payment for obsolete equipment – and even equipment you no longer use – if your lease doesn't include upgrades and your term hasn't ended.

What is the advantage of leasing to lessor

Tax Advantage: Because the lessor owns the asset, the lessor receives a tax benefit in the form of depreciation on the leased asset. Profitability is high: Leasing is a highly profitable business because the rate of return on lease rentals is much higher than the interest paid on the asset's financing.

What is the basic of leasing

Leasing makes available to you an asset or assets for generally (though not necessarily) a minimum period for a regular (usually fixed) rental. A lease agreement is drawn up between the owner of the asset (lessor) and the user of the asset (lessee) and is a legal contract with rights and obligations on both sides.

What are sensible reasons for leasing

Here are just some of the reasons why:Capital Preservation.Credit Preservation.Easier Budgeting.Financial Efficiency.Flexibility.Tax Deferral.More Purchasing Power.Financing of “Soft Costs”

What is the main feature of leasing

It guarantees the lessee, also known as the tenant, use of the property and guarantees the lessor (the property owner or landlord) regular payments for a specified period in exchange. Both the lessee and the lessor face consequences if they fail to uphold the terms of the contract.

Why leasing is more popular

In the event they would rather continue driving new cars every few years, they can simply return the vehicle and begin a new lease agreement on a newer one. Overall, leasing a car is evidently popular for its flexibility, low costs and the ability it gives drivers to renew their vehicles frequently.

What are two advantages of leasing assets

When compared with purchasing equipment, leasing can allow you to:Take control of your cash flow.Avoid end of term ownership responsibilities.Reduce costs.Stay up to date.Manage your capital and debt.Maintain flexible security over assets.

Is there any difference between leasing and purchase

The term buying refers to purchasing the asset by paying the price for it. Leasing is an arrangement wherein the owner of the asset permits another person to use the asset, for recurring payments.

What is the primary advantage of leasing

Conserves Cash: Leasing provides 100% financing. Capital can be conserved and used to finance other projects or activities. Access to Capital: Leasing does not impact existing credit lines – e.g. an existing bank operating line, thereby providing another source of capital.

Why leasing is profitable

Most lessors earn profit through significant charges outside of the regular term rent stream, including interim rent, retained deposits, fees, lease extensions, non-compliant return charges, fair market value definitions, and end-of-lease buyouts for equipment that cannot be returned.

Why do people prefer leasing

Benefits of leasing usually include a lower up-front cost, lower monthly payments compared to buying, and no resale hassle. Benefits of buying usually are car ownership, complete control over mileage, and a firm idea of costs.

Why do most people lease

On the surface, leasing can be more appealing than buying. Monthly payments are usually lower because you're not paying back any principal. Instead, you're just borrowing and repaying the difference between the car's value when new and the car's residual—its expected value when the lease ends—plus finance charges.

What are the main types of leasing

The three main types of leasing are finance leasing, operating leasing and contract hire.

What is the objective of leasing

Planning Cash Flows: Leasing enables the lessee to plan its cash flows properly. The rentals can be paid out of the cash coming into the business from the use of the same assets. Improvement in Liquidity: Leasing enables the lessee to improve its liquidity position by adopting the sale and leaseback technique.

0 Comments