What are three common types of leases?

What are the main types of leasing

The three main types of leasing are finance leasing, operating leasing and contract hire.

What are three types of lease arrangements

There are different types of leases, but the most common types are absolute net lease, triple net lease, modified gross lease, and full-service lease. Tenants and proprietors need to understand them fully before signing a lease agreement.

What are the two most common types of leases

The two most common types of leases are operating leases and financing leases (also called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

What is the most common lease term

One-year leases

One-year leases are by far and large the most popular length for leases. They're good if you have high-quality tenants and an effective tenant screening process in place. In this case, year-long leases are good because it secures good tenants for a long period of time.

What are the five primary types of leases

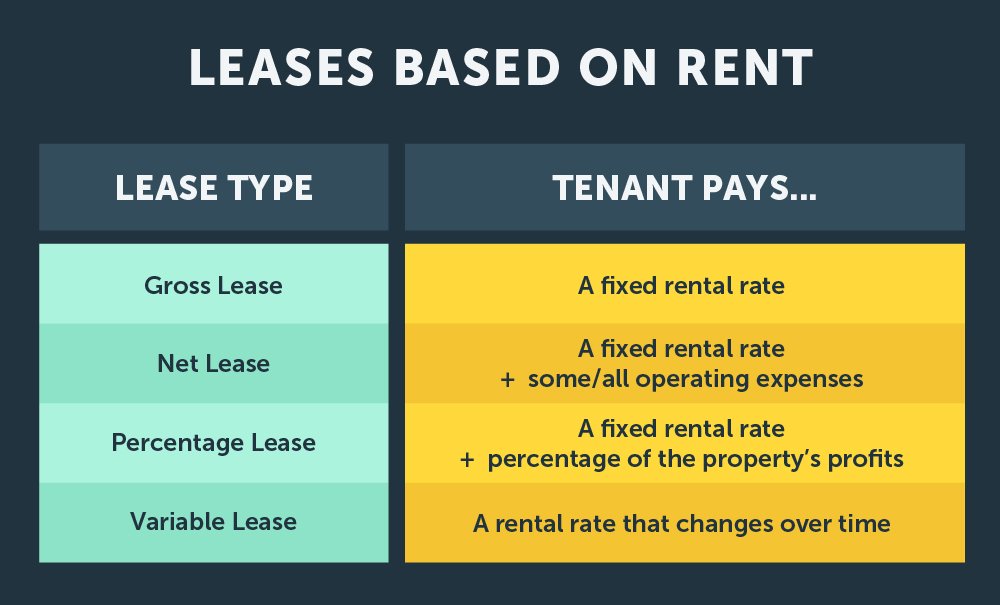

5 Different Types of Commercial LeasesFull-Service Lease. Also called a Gross Lease, a full-service lease is commonly used in commercial buildings occupied by multiple tenants, like office buildings.Net Lease.Modified Gross Lease.Absolute NNN Lease.Percentage Lease.

What are the four primary leases

There are, in general, four types of leases: the gross lease, the modified gross lease (or net lease), the triple net lease, and the bond lease.

What is the simplest type of lease

A full-service gross lease, or gross lease, is the simplest type of commercial lease. In this structure, the landlord charges the tenant a gross lump sum payment every month.

What are the 2 types of lease financing

What is Lease Financing A lease is a simple financing structure that allows a customer to use energy efficiency, renewable energy, or other generation equipment without purchasing it outright. The two most common types are on-balance sheet capital leases and off-balance sheet operating leases.

What are the types of leases for lessee

The lessor is the owner of the assets identified in the agreement. There are two types of lease classifications for a lessee: finance and operating. There are three types of leases for a lessor: direct financing, sales-type, and operating leases.

What are the two types of leases explain

Operating Vs Finance leases (What's the difference):

Title: In a finance lease agreement, ownership of the property is transferred to the lessee at the end of the lease term. But, in an operating lease agreement, the ownership of the property is retained during and after the lease term by the lessor.

0 Comments