What are three disadvantages of leasing?

What are the disadvantages of leasing a company

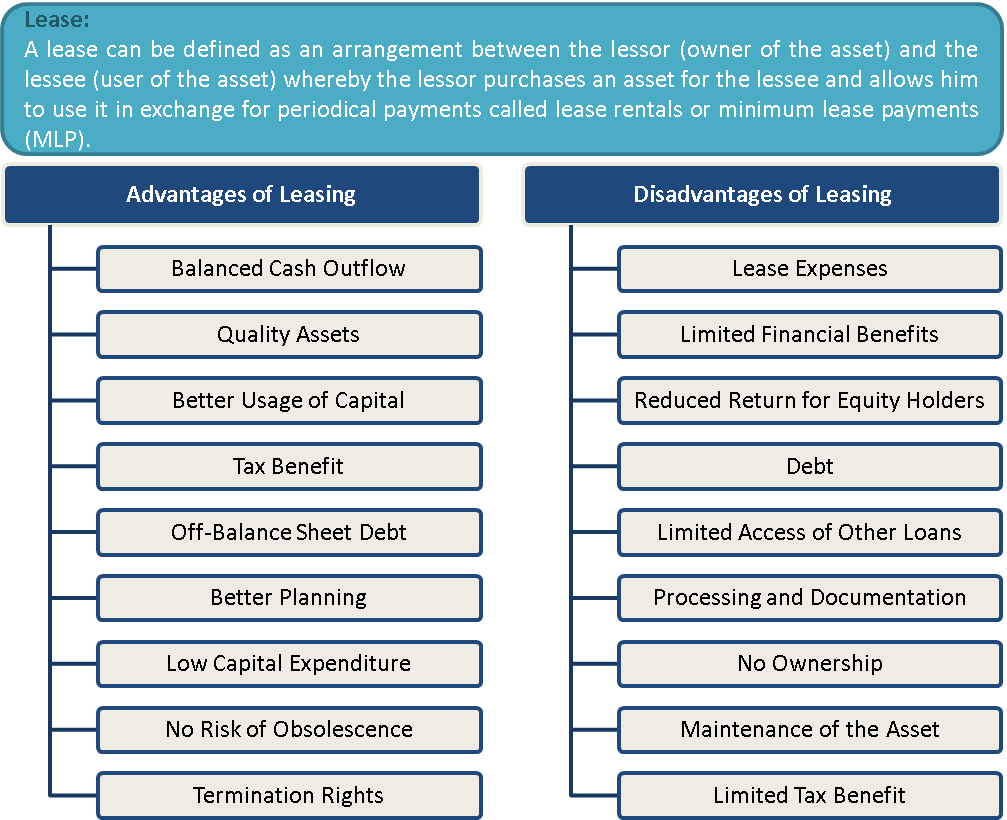

you may have to put down a deposit or make some payments in advance. it can work out to be more expensive than if you buy the assets outright. your business can be locked into inflexible medium or long-term agreements, which may be difficult to terminate.

What are advantages and disadvantages of leasing

LeasingLower monthly payments.Little or no down payment.More expensive car for less money.More cash available for other purchases.Sales taxes paid over term of lease.Possible tax benefits – check with your accountant.

What are the limitations of leasing

Various disadvantages of leasing to the lessor associated with leasing of the property or asset are as follows:No Benefits of Price Rise.Increased Cost Due to User Benefit's Loss.Market Competition.Long-Term Investment.Cash-Flow Management.High Risk of Obsolescence.

What are two advantages of leasing

Conserves Cash: Leasing provides 100% financing. Capital can be conserved and used to finance other projects or activities. Access to Capital: Leasing does not impact existing credit lines – e.g. an existing bank operating line, thereby providing another source of capital.

What is the problem of leasing

The lease becomes economically viable only when the transfer's effective tax rate is low. In addition, taxes like sales tax, wealth tax, additional tax, surcharge etc. add to the cost of leasing. Thus leasing becomes more expensive form of financing than conventional mode of finance such as hire purchase.

What are the risks in leasing business

Risk classification of a leasing company. The group of external risks includes the following: legal and political risks, currency and interest risks, social and environmental risks, marketing risk and client insolvency risk. The latter implies the impossibility of the lessee making payments under the lease agreement.

What is leasing advantages in finance

Finance leasing benefits

It offers flexibility in terms of length of agreement, rental repayment profile and end of lease options. Unlike outright purchase you will retain much needed cash within your business to meet ongoing and exceptional running costs.

What is the purpose of leasing

It guarantees the tenant or lessee use of the property and guarantees the property owner or landlord regular payments for a specified period in exchange. Residential leases tend to be the same for all tenants, but there are several different types of commercial leases.

What are 5 disadvantages of leasing

Cons of Leasing a CarYou Don't Own the Car. The obvious downside to leasing a car is that you don't own the car at the end of the lease.It Might Not Save You Money.Leasing Can Be More Complicated than Buying.Leased Cars Are Restricted to a Limited Number of Miles.Increased Insurance Premiums.

What is the point of leasing

Lower monthly payments

One of the greatest advantages of leasing a car is typically lower monthly payments than if you were obtaining financing to purchase the car. When you finance a vehicle purchase, you pay the entire purchase price of a vehicle over the life of the financing plus interest.

What are the factors affecting leasing

Factors Favoring Leasing:

Credit rating: The company has not established a credit rating sufficient to support a mortgage. Maintenance: The landlord is responsible for maintaining the property. Property: You have been unable to find a suitable property that is for sale.

What are the risks of a short lease

What's wrong with a short leaseProblems getting a mortgage. Many lenders won't lend on flats with a lease already below the 80-year mark.You'll have to pay for a costly lease extension.You could be faced with extortionate costs.Seller might not agree to extend the lease.Delays from extending the lease.

Why leasing is profitable

Most lessors earn profit through significant charges outside of the regular term rent stream, including interim rent, retained deposits, fees, lease extensions, non-compliant return charges, fair market value definitions, and end-of-lease buyouts for equipment that cannot be returned.

What are the types of lease

Types of LeasingFinance Lease.Operating Lease.Leveraged Lease.Conveyance Lease.Sale and Leaseback.Complete and Non-Pay-Out Lease.Specialised Service Lease.Net and Non-Net Lease.

What is the one advantage of a lease

Lower monthly payments

One of the greatest advantages of leasing a car is typically lower monthly payments than if you were obtaining financing to purchase the car. When you finance a vehicle purchase, you pay the entire purchase price of a vehicle over the life of the financing plus interest.

What are sensible reasons for leasing

Here are just some of the reasons why:Capital Preservation.Credit Preservation.Easier Budgeting.Financial Efficiency.Flexibility.Tax Deferral.More Purchasing Power.Financing of “Soft Costs”

Why is a low lease bad

As the lease on a property becomes shorter, the more it's value declines. A property that is quickly losing value is not appealing for prospective buyers or mortgage companies. As most banks and companies will not provide mortgages for properties with a lease of less than 70 years, the market is limited to cash-buyers.

What are the disadvantages of long-term lease

Drawbacks of long-term leases are locking yourself in a rental rate, risking having a less-than-desirable tenant, and giving yourself too little flexibility.

Is it a waste of money to lease

Additionally, leased vehicles don't typically retain equity when you lease, what you owe on the car only catches up to its value at the end of a lease. This could be viewed as a waste of money by some since you're not in an equity position at lease end.

Why do people prefer leasing

Benefits of leasing usually include a lower up-front cost, lower monthly payments compared to buying, and no resale hassle. Benefits of buying usually are car ownership, complete control over mileage, and a firm idea of costs.

What are the two main types of lease

The two most common types of leases are operating leases and financing leases (also called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

What is the most common lease

Triple Net Lease

A Triple Net Lease (NNN Lease) is the most common type of lease in commercial buildings. In a NNN lease, the rent does not include operating expenses. Operating expenses include utilities, maintenance, property taxes, insurance and property management.

What is the difference between a lease and a loan

What are the differences in a loan vs. lease Loans and lease financing are both popular methods of funding, but there is a key distinction between the two. A loan is the borrowing of money while a lease is a term rental agreement for the use of specific equipment.

Why do we have leases

Rental landlords were faced with new laws holding down rents and restricting their rights to evict tenants. Many of them, faced with dwindling profits, started to sell longer leases, typically 99 or 125 years, to bring in more money. This was the beginning of the modern leasehold system that we know today.

Why do most people lease

On the surface, leasing can be more appealing than buying. Monthly payments are usually lower because you're not paying back any principal. Instead, you're just borrowing and repaying the difference between the car's value when new and the car's residual—its expected value when the lease ends—plus finance charges.

0 Comments