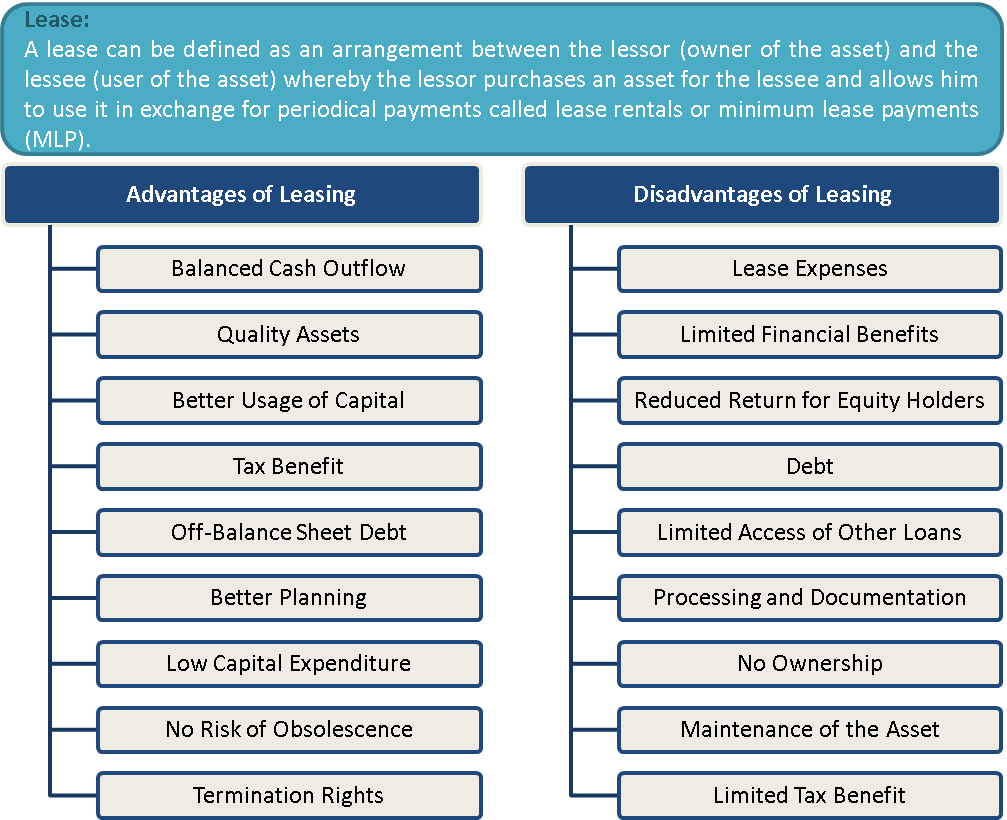

What is the disadvantage of leasing in business?

What are the disadvantages of leasing a company

you may have to put down a deposit or make some payments in advance. it can work out to be more expensive than if you buy the assets outright. your business can be locked into inflexible medium or long-term agreements, which may be difficult to terminate.

What is the primary disadvantage of leasing

The major disadvantages to leasing are that after a lease, you have nothing to show for it–unless you have a buyout option, and internal interest rates (that are already figured into the lease cost) are typically more expensive.

What is leasing and its advantages and disadvantages

Leasing is the easiest method of financing fixed assets. No mortgage or hypothecation is required. Restrictions involved in long-term borrowing from financial institutions are avoided. Formalities involved in leasing are much less than in case of borrowing from financial institutions.

What is the problem of leasing

The lease becomes economically viable only when the transfer's effective tax rate is low. In addition, taxes like sales tax, wealth tax, additional tax, surcharge etc. add to the cost of leasing. Thus leasing becomes more expensive form of financing than conventional mode of finance such as hire purchase.

What are the few disadvantages of leasing

Cons of Leasing a CarYou Don't Own the Car. The obvious downside to leasing a car is that you don't own the car at the end of the lease.It Might Not Save You Money.Leasing Can Be More Complicated than Buying.Leased Cars Are Restricted to a Limited Number of Miles.Increased Insurance Premiums.

What is leasing in business advantages

Conserves Cash: Leasing provides 100% financing. Capital can be conserved and used to finance other projects or activities. Access to Capital: Leasing does not impact existing credit lines – e.g. an existing bank operating line, thereby providing another source of capital.

What are the disadvantages of employee leasing

Negatives of Employee LeasingCommitment Issues. Since these are leased employees, they do lack commitment at times.Lack of loyalty and motivation.Dependency on third-party.The cost of leasing.Lack of interpersonal relationships.

What is the advantage of leasing companies

Leasing can help you avoid onerous end-of-term ownership responsibilities and costs, particularly around the disposal of obsolete assets per government regulations. For example, a lessor can also assist with onsite decommissioning, packaging, transportation, wiping and remarketing costs.

What are the factors affecting leasing

Factors Favoring Leasing:

Credit rating: The company has not established a credit rating sufficient to support a mortgage. Maintenance: The landlord is responsible for maintaining the property. Property: You have been unable to find a suitable property that is for sale.

What are 5 disadvantages of leasing

Cons of Leasing a CarYou Don't Own the Car. The obvious downside to leasing a car is that you don't own the car at the end of the lease.It Might Not Save You Money.Leasing Can Be More Complicated than Buying.Leased Cars Are Restricted to a Limited Number of Miles.Increased Insurance Premiums.

What is leasing in business environment

Leasing is a process by which a firm can obtain the use of certain fixed assets for which it must pay a series of contractual, periodic, tax deductible payments.

What is the purpose of leasing company

By definition: "Financial leasing companies engage in financing the purchase of concrete assets. Though leasing company is the legal owner of the goods, the ownership and possession is effectively conveyed to the lessee, who earns all benefits, costs, and risks linked to ownership of the assets.”

What is the impact of lease financing

Financing leases are treated as assets and liabilities on the balance sheet and as interest and depreciation expenses on the income statement. Therefore, financing leases increase your assets and liabilities and reduce your net income and your operating cash flow.

What are the limitations of lease finance

To Lessor: The following are the disadvantages of lease financing from the perspective of the lessor: In the event of inflation, it is unprofitable: Every year, the lessee receives a fixed amount of lease rental, which they cannot increase even if the asset's cost rises. So, it is unprofitable during inflation.

What are the main advantages of leasing

There are numerous advantages to lease financingLess initial cash investment required.Lower monthly payments.Tax benefits.Fast turnaround time.Conserve your capital.Avoid technological obsolescence.Assist corporate growth.Let the equipment pay for itself.

What is the major advantage of leasing

Conserves Cash: Leasing provides 100% financing. Capital can be conserved and used to finance other projects or activities. Access to Capital: Leasing does not impact existing credit lines – e.g. an existing bank operating line, thereby providing another source of capital.

Why is leasing important in business

There are many reasons why companies lease equipment. Equipment leasing provides flexibility and protection against technological obsolescence. Leasing allows a company to better match cash outflow with revenue productions through the use of equipment. Leasing conserves valuable working capital and bank lines.

What is the purpose of leasing

It guarantees the tenant or lessee use of the property and guarantees the property owner or landlord regular payments for a specified period in exchange. Residential leases tend to be the same for all tenants, but there are several different types of commercial leases.

Why leasing is profitable

Most lessors earn profit through significant charges outside of the regular term rent stream, including interim rent, retained deposits, fees, lease extensions, non-compliant return charges, fair market value definitions, and end-of-lease buyouts for equipment that cannot be returned.

What is leasing advantages in finance

Finance leasing benefits

It offers flexibility in terms of length of agreement, rental repayment profile and end of lease options. Unlike outright purchase you will retain much needed cash within your business to meet ongoing and exceptional running costs.

Is it a waste of money to lease

Additionally, leased vehicles don't typically retain equity when you lease, what you owe on the car only catches up to its value at the end of a lease. This could be viewed as a waste of money by some since you're not in an equity position at lease end.

Why leasing is more popular

In the event they would rather continue driving new cars every few years, they can simply return the vehicle and begin a new lease agreement on a newer one. Overall, leasing a car is evidently popular for its flexibility, low costs and the ability it gives drivers to renew their vehicles frequently.

How much does it cost to lease a car in the UK

The average cost to lease a car usually ranges from £100 to £1000 per month (maybe more), but there are lots of factors that can change your monthly payment amount.

What is the one advantage of a lease

Lower monthly payments

One of the greatest advantages of leasing a car is typically lower monthly payments than if you were obtaining financing to purchase the car. When you finance a vehicle purchase, you pay the entire purchase price of a vehicle over the life of the financing plus interest.

How does lease work

You pay an initial rental then consecutive monthly rentals spread over the agreed term often making leasing a cheaper alternative to buying a new car. One of the greatest advantages of leasing is you won't need to worry about the vehicle losing value over time.

0 Comments