What is a main disadvantage of leasing?

What are the disadvantages of leasing

Disadvantages of leasing or renting equipment

you can't claim capital allowances on the leased assets if the lease period is for less than five years (and in some cases less than seven years) you may have to put down a deposit or make some payments in advance.

What are advantages and disadvantages of leasing

LeasingLower monthly payments.Little or no down payment.More expensive car for less money.More cash available for other purchases.Sales taxes paid over term of lease.Possible tax benefits – check with your accountant.

What is the major advantage of leasing

Conserves Cash: Leasing provides 100% financing. Capital can be conserved and used to finance other projects or activities. Access to Capital: Leasing does not impact existing credit lines – e.g. an existing bank operating line, thereby providing another source of capital.

What are 2 benefits of leasing

Pros of leasing a carLower monthly payments. A monthly lease payment may be less than a loan payment on the same car.Fewer costly repairs. Generally, leased cars are newer and in better condition.A safer vehicle.Tax advantages.Easy returns.

What are 5 disadvantages of leasing

Cons of Leasing a CarYou Don't Own the Car. The obvious downside to leasing a car is that you don't own the car at the end of the lease.It Might Not Save You Money.Leasing Can Be More Complicated than Buying.Leased Cars Are Restricted to a Limited Number of Miles.Increased Insurance Premiums.

What is the problem of leasing

The lease becomes economically viable only when the transfer's effective tax rate is low. In addition, taxes like sales tax, wealth tax, additional tax, surcharge etc. add to the cost of leasing. Thus leasing becomes more expensive form of financing than conventional mode of finance such as hire purchase.

What is the purpose of leasing

It guarantees the tenant or lessee use of the property and guarantees the property owner or landlord regular payments for a specified period in exchange. Residential leases tend to be the same for all tenants, but there are several different types of commercial leases.

What are the disadvantages of a leveraged lease

The most significant disadvantage of leverage is that there is a risk that a company will use too much leverage, which can lead to problems for the company because there will be no benefit to taking leverage beyond an optimum level of leverage.

Which of the following is not an advantage of leasing

Answer. A correct choice is an option a)- No tax benefits for the lessor. A lease refers to the contract under which the owner of the property permits other parties to utilize the asset in an exchange for anything.

What is leasing used for

Leasing a business is the temporary transfer of assets such as vehicles, buildings, or industry equipment from one business to another. The lessor will deliver the assets to the lessee in return for regular lease payments under the lease agreement.

What are the risks in leasing business

Risk classification of a leasing company. The group of external risks includes the following: legal and political risks, currency and interest risks, social and environmental risks, marketing risk and client insolvency risk. The latter implies the impossibility of the lessee making payments under the lease agreement.

What are the factors affecting leasing

Factors Favoring Leasing:

Credit rating: The company has not established a credit rating sufficient to support a mortgage. Maintenance: The landlord is responsible for maintaining the property. Property: You have been unable to find a suitable property that is for sale.

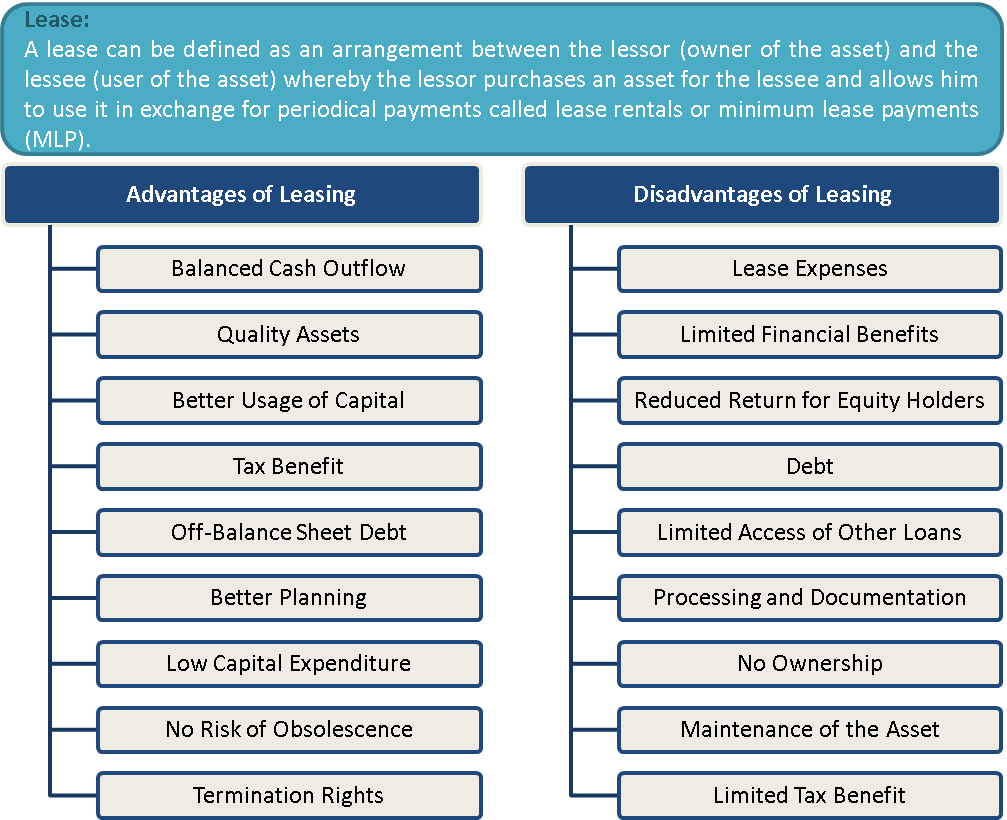

What is the concept of leasing

A Lease can be defined as a contract where a party being the owner (lessor) of an asset (leased asset) provides the asset for use by the lessee at a consideration (rental), either fixed or dependent on any variables, for a certain period (lease period), either fixed or flexible, with an understanding that at the end of …

What is the main disadvantage of leverage

The biggest risk that arises from high financial leverage occurs when a company's return on ROA does not exceed the interest on the loan, which greatly diminishes a company's return on equity and profitability.

What is the disadvantage of equipment lease

Disadvantages of Equipment LeasingThe equipment is not owned by the business.Interest is being paid by the business.Accessibility of equipment leasing is restricted for new businesses.Limited range of products to lease.Penalties.

Which is not an advantage of leasing vs purchasing

Leasing also has disadvantages, including: Potentially higher overall costs, depending on the length of the lease's term. Continued payment for obsolete equipment – and even equipment you no longer use – if your lease doesn't include upgrades and your term hasn't ended.

Is leasing short or long term

A short-term lease agreement lasts anywhere from three to six months, or can go month-to-month until the tenant decides to move out. Long-term leases are anything longer than six months and can go up to 15 months before needing to make a new lease.

What are the types of lease

Types of LeasingFinance Lease.Operating Lease.Leveraged Lease.Conveyance Lease.Sale and Leaseback.Complete and Non-Pay-Out Lease.Specialised Service Lease.Net and Non-Net Lease.

What are sensible reasons for leasing

Here are just some of the reasons why:Capital Preservation.Credit Preservation.Easier Budgeting.Financial Efficiency.Flexibility.Tax Deferral.More Purchasing Power.Financing of “Soft Costs”

What are examples of leasing

Answer: Leasing typically refers to a longer-term agreement, often for a year or more, whereas renting may be for a shorter period of time. For example, a tenant might rent an apartment for a few months but lease a commercial property for several years.

What are the main types of leasing

The three main types of leasing are finance leasing, operating leasing and contract hire.

What are the advantages of a leveraged lease

The leveraged lease is also a tax advantage for the lessor since the lessor takes a loan from the lender to purchase the asset while the payment from the lessee will directly go to the lender. Thus they are saving tax in this entire process. This type of arrangement is mostly seen while purchasing high-value assets.

What is leasing instead of buying

Difference Between Buying and Leasing. Buying refers to owning the right on an asset or property. On the other hand, leasing refers to the permission granted to entities for using an asset or property on behalf of the owners.

Is there any difference between leasing and purchase

The term buying refers to purchasing the asset by paying the price for it. Leasing is an arrangement wherein the owner of the asset permits another person to use the asset, for recurring payments.

How long a lease should be

There is no hard and fast rule about the minimum length a lease should be when it is sold. However, a number of buyers will be discouraged from buying a lease that is nearing or less than 80 years in length. When the length of a lease falls below 80 years, the cost of a lease extension increases dramatically.

0 Comments